The return-to-office (RTO) movement is reshaping the landscape of commercial real estate (CRE). As companies refine their workplace strategies, the ripple effects on leasing trends, office space demand, and urban development are becoming increasingly evident.

Key Drivers of the Return-to-Office Movement

- Hybrid vs. Full-Time Models: The shift toward hybrid and full-time office work continues to evolve with companies adopting varying policies. Amazon recently announced a stricter RTO mandate requiring employees to be in the office five days a week starting in early 2025, emphasizing the benefits of in-person collaboration and company culture. Similarly, JPMorgan Chase and Goldman Sachs have reinforced full-time office attendance, citing concerns over productivity and decision-making delays. Meanwhile, some companies are using incentives to encourage more in-office presence.

- Productivity and Collaboration: The push for stricter RTO policies is largely driven by concerns over workplace effectiveness. JPMorgan Chase CEO Jamie Dimon has been vocal about remote work’s impact on productivity, arguing that in-office environments foster faster decision-making and spontaneous collaboration. This trend reflects a broader corporate focus on ensuring employees are fully engaged and maximizing output in team-driven settings.

- Cultural Reinvestment: Beyond productivity, many companies see RTO as a way to reinforce corporate culture and employee engagement. AT&T, for example, has tightened its RTO requirements to strengthen workplace identity and foster deeper connections among employees. This renewed emphasis on office culture is driving demand for high-quality properties that support collaboration, wellness, and employee satisfaction.

CRE Implications of RTO Policies

- Increased Demand for Premium Office Spaces: The “flight to quality” continues, with tenants prioritizing Class A office buildings featuring top-tier amenities, wellness features, and ESG certifications. Leasing activity has rebounded in high-demand markets like Atlanta, Austin, and Charlotte as companies seek well-located, high-quality spaces to accommodate returning employees.

- Reevaluating Secondary Markets: While urban centers like Manhattan and San Francisco are seeing increased leasing, secondary and suburban markets are facing challenges. Some underperforming office properties in these areas are being repositioned for alternative uses, such as residential conversions.

- Flexible Spaces and Short-Term Leases: While some companies are committing to full-time in-office mandates, others remain cautious about long-term space needs. This has led to increased demand for co-working spaces, shorter lease terms, and more adaptable office environments.

- Impact on Building Design: Tenants are demanding workspaces that promote collaboration, including open layouts, technology-integrated workstations, and enhanced meeting areas. Sustainability and wellness are now key differentiators, with buildings that lack these features seeing higher vacancy rates. JLL research shows that only 11.4% of buildings saw increased vacancies in Q4 2024, largely due to upgrades to more amenitized properties.

- Investor Confidence and Supply Constraints: While office sales saw their first uptick since 2021, much of the capital is flowing into high-quality buildings or those with potential for renovation and repositioning. Additionally, new office construction has slowed, leading to supply shortages in select markets, which could impact leasing trends in 2025.

Looking Ahead

As more companies implement and refine RTO policies, the focus is shifting to delivering properties that align with tenant priorities, including flexibility, sustainability, and premium amenities. By understanding the evolving needs of tenants and leveraging innovative strategies, the industry can thrive in this new era of work.

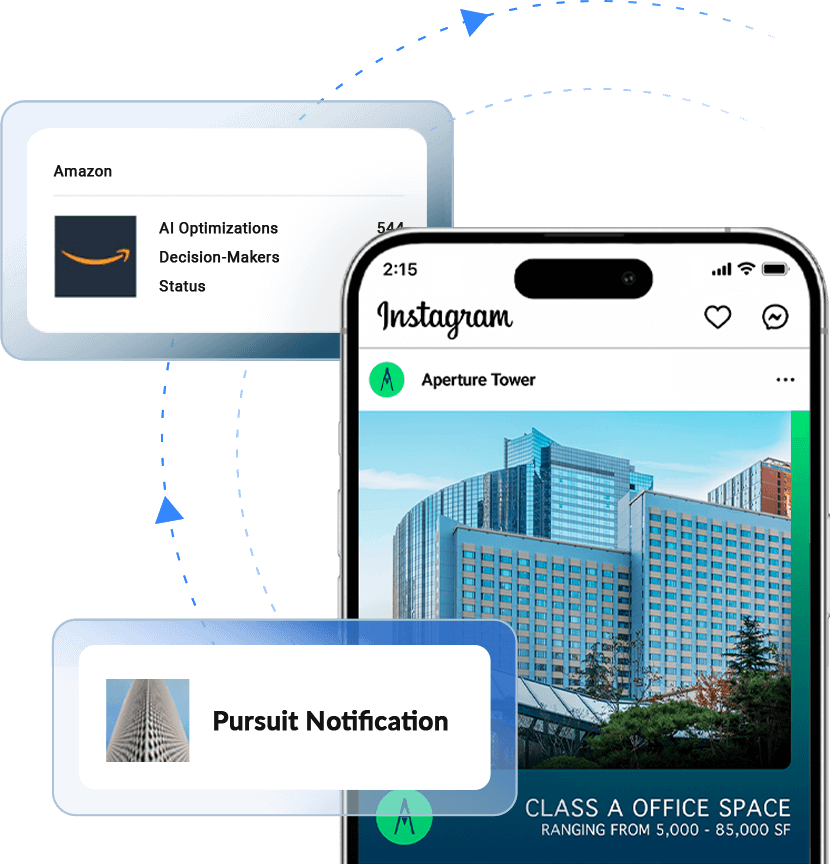

RealtyAds is helping commercial real estate find, advance, and close more deals by engaging decision-makers and their representation on the world’s most effective customer acquisition channels. For more information, visit RealtyAds.com and follow RealtyAds on LinkedIn, Facebook, and Instagram.